⚡️ Are Shoebox Miners Cargo Cult?

Happy 190-days A.H. everyone.

Ever spent time upgrading machines, re-arranging your racks to fit the new design, and having to get rid of the old equipment? With Bitmain’s new rack-style ASIC there is the potential to alleviate some of these pains and allow miners to upgrade their facilities by just sliding in new hash boards straight into the existing racks.

Sponsored by Compass

Compass is a unique mining and hosting platform. Launched by our friends over at HASHR8, Compass makes bitcoin mining accessible to everyone.

Small-scale miners can now effectively compete by securing hosting space and accessing some of the lowest electricity rates in the industry. Compass also offers miners the newest and most efficient hardware at the best available prices.

It's time to start mining today. Visit Compass and get started mining now.

Trading Update

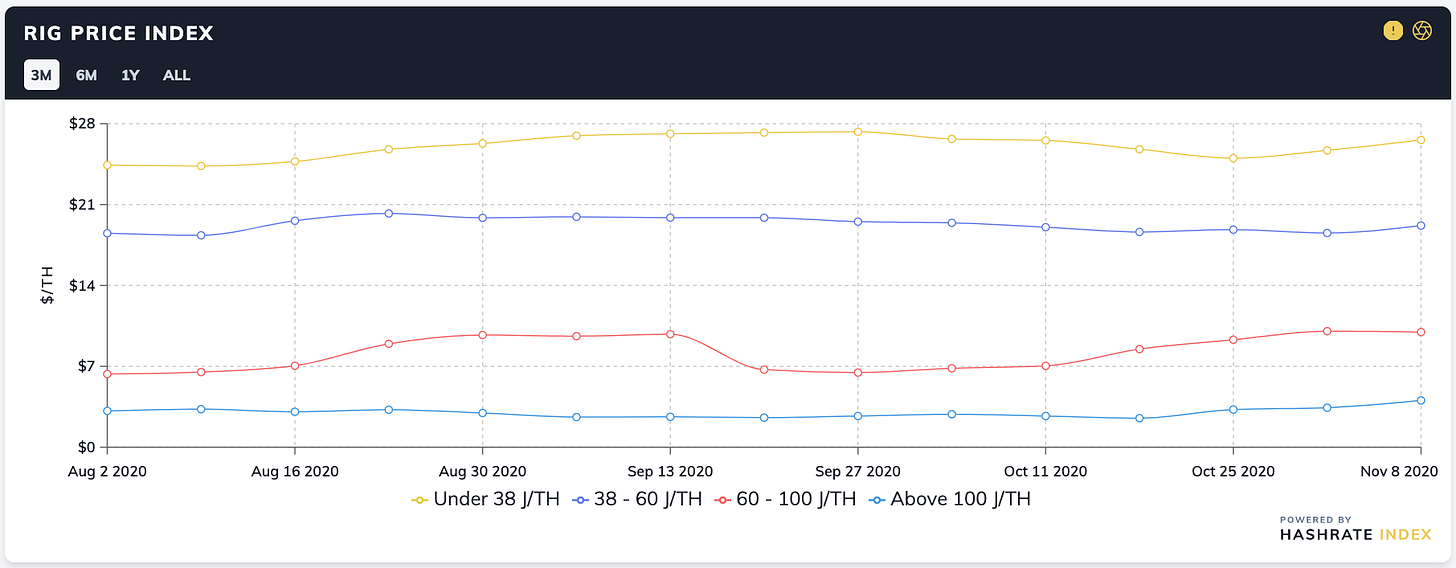

Rig Price Index

With the jump in mining profitability comes an increase in ASIC prices. It is well documented that prices roughly track the value of hashrate (and hence payback period) quite closely. Although miners would prefer the manufacturers to use a cost-based approach to pricing, they favor competitor and value-based pricing strategies. This is also true in the secondary markets when miners look to liquidate their rigs.

ASIC prices are up ~3-5% across efficiency buckets this month.

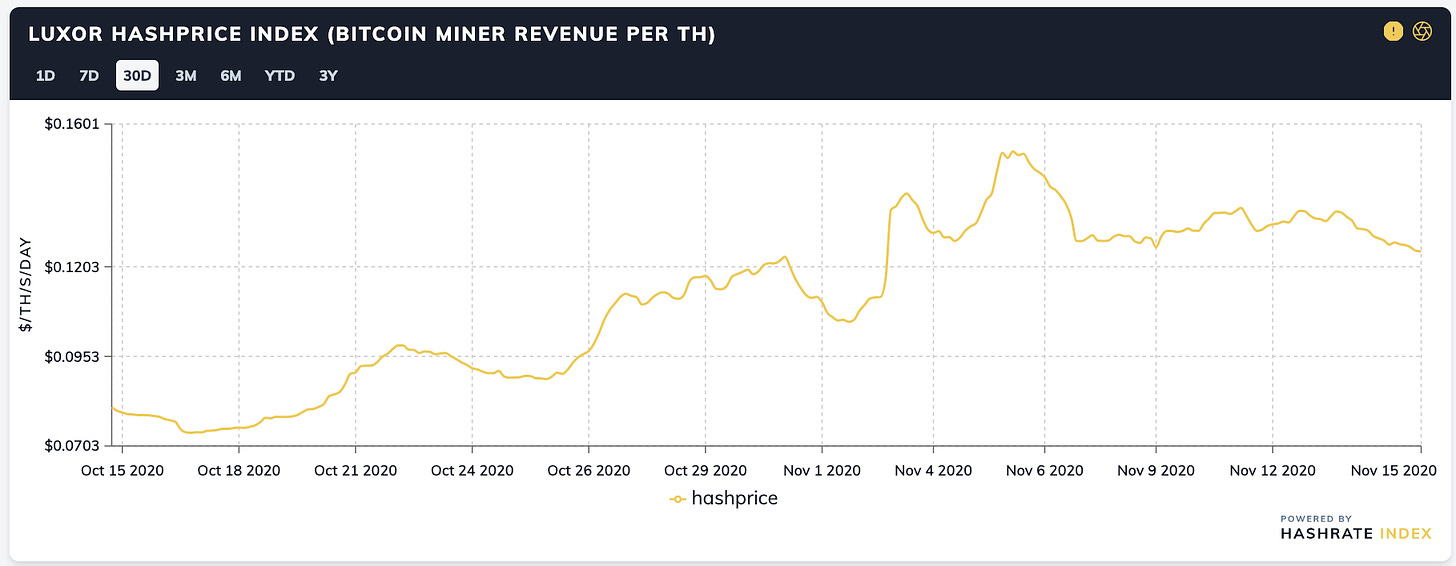

Hashprice Index

Mining revenue has been trading in the 12 to 15 cent a TH range since the last difficulty adjustment (-16%). Transaction fees have been all over the place and now represent less than 5% of the block reward.

Difficulty is adjusting upwards by 5% in an hour, as rigs have mostly come back online from the move from Sichuan to other provinces in China and elsewhere.

Difficulty Futures

FTX’s Q4 2020 Difficulty Future is down ~2.9% from the last update to 20.735 T. This represents an expected ~18% increase for the rest of the quarter over the current difficulty.

Mining News

Bitmain Releases New Rack-Style Miners

Since the beginning of mainstream ASICs, the shoebox form factor has dominated the market. While there have been attempts at changing the form factor to date (Bitfury, Canaan) it hasn’t been disrupted. Bitmain’s new release could be the first real run at changing this. (announcement)

The AntRack adopts a module design, including five key modules – the Rack, Switch Board, Servers, Main Control Panel, and Water Cooling System, and the standard parts – hash boards, control panel, power supply unit (PSU), and fans. The hot-swappable design of the AntRack allows replacing the hash board with the latest generation chipsets (7nm eventually to 5nm, 3nm, etc) without having to swap out the entire machine.

Some miners believe this will help solve their deployment issues and open up traditional data centers to mining. Others are pointing out that this will require the mining farms to refactor shelving & infrastructure and may result in density issues.

Prices and performance have not yet been released, and as always it is the key determinant in deciding whether the AntRack will be a good investment to make.

Blockseer Launches a KYC Bitcoin Pool

DMG Blockchain, through its subsidiary Blockseer has launched a new mining pool aimed at exceeding the US Government’s Office of Foreign Assets Control (OFAC) compliance for BTC addresses. Specifically, the pool will integrate DMG’s crypto forensics data, including Walletscore, to ensure that all transactions included in the blocks they mine are OFAC compliant.

To our understanding, it doesn't mean that they won't recognize other blocks mined by different pools that do include OFAC sanctioned addresses. They will still be mining on the longest chain. This popular Twitter thread proposed that as a possibility. By not including blacklisted transactions in their block template they aren’t increasing the chances of orphaning a block.

Blockseer’s perspective is that nefarious actors sully the reputation of Bitcoin and blocking them out is a positive for the ecosystem. They are only creating an option for miners who wish to exceed OFAC compliance.

Some skeptics are highlighting that this pool is bringing censorship to Bitcoin, which derives its value from being censorship-resistant. In addition, people have different definitions of who a nefarious actor is.

My thoughts on this are that as long as not every pool in the world operates on the same censorship list, then the network is still censorship-resistant. The DMG pool will operate for a certain group of North-American organizations, and the transaction they don’t include in their block will quickly get picked up by another pool.

TSMC’s Board Approves Arizona Expansion

TSMC, the world’s biggest chipmaker, approved an investment to set up a wholly-owned subsidiary in Arizona with a paid-in capital of $3.5 billion. Construction of the facility will start in 2021 with production targeted to begin in 2024. They aim to process up to 20,000 silicon wafers per month. (article)

The investment is part of the plan that TSMC announced in May to build a $12 billion factory in Arizona, seen as an apparent win for America to wrestle global tech supply chains back from China.

It’s yet to be determined if any of this allocation will be available for Bitcoin mining. Likely the majority will go to players like Apple, who the US government will see as a more strategic use of American-made chips.

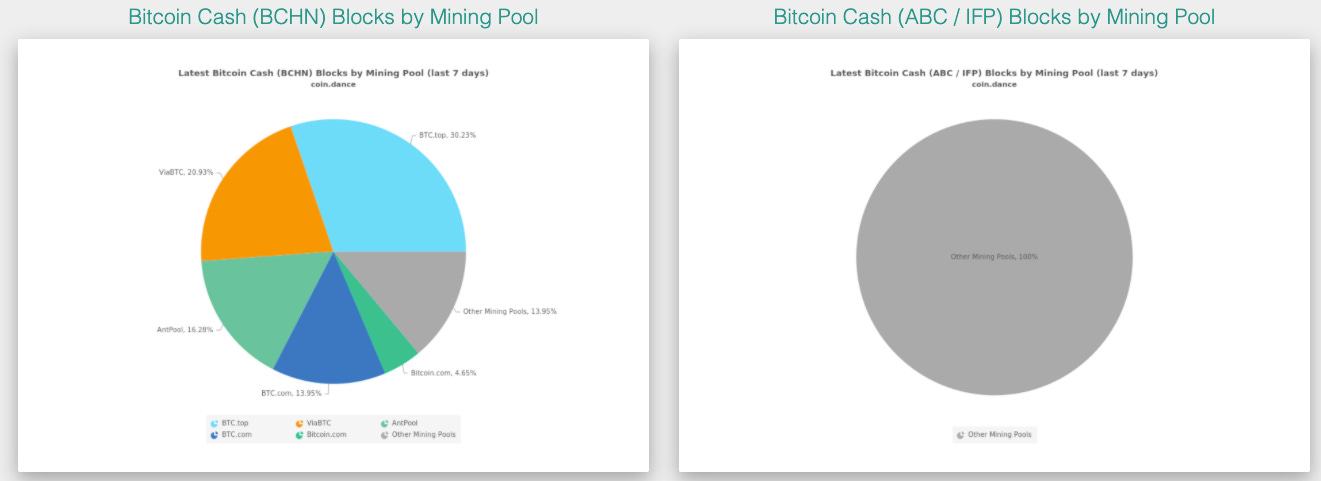

BCH Fork

A group of Bitcoin Cash developers (BCH ABC), proposed an update on the Bitcoin Cash network, which included a controversial new “Coinbase Rule,” requiring 8% of mined bitcoin cash to be redistributed to BCH ABC as a means of financing the protocol development. The upgrade is opposed by another group from the Bitcoin Cash community, known as Bitcoin Cash Node, who removed this so-called “miner tax” from their source code. (Article)

It appears that most miners chose BCHN including all the major mining pools. We will see if BCH ABC has a change of success with such limited miner support (~150 PH) or if it will be the next ETC and be 51% attacked through hashrate rentals.

For a period of time, BCH was significantly more profitable to mine than Bitcoin with many of the SHA256 profit-switching algorithms staying on BTC until there was clarity on how the fork would play out.

Mining Educational Content

In 2018 we launched a 2.5MW site in Kansas City with no ASIC Management Sofware. The result was burning hundreds of hours of labor doing manual changes and losing out on hashrate production by not detecting low-hashing and offline machines. In an era of hyper-competitiveness, miners need to consider using this software to run good mining operations.

About Luxor

Luxor is a US-based mining company.

We run a best-price platform for SHA-256 (Bitcoin) and Equihash. We operate mining pools for Dash, Zcash, Horizen, Decred, Sia, and more.

We also run mining data website, Hashrate Index.